Sg2 2021 Impact of Change® Forecast: Post-Pandemic Recovery, Rising Acuity and Ambulatory Shifts

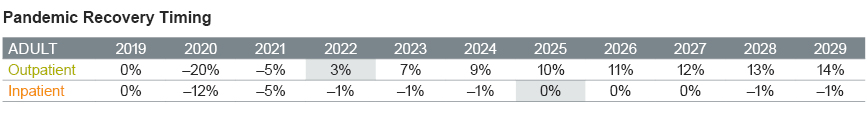

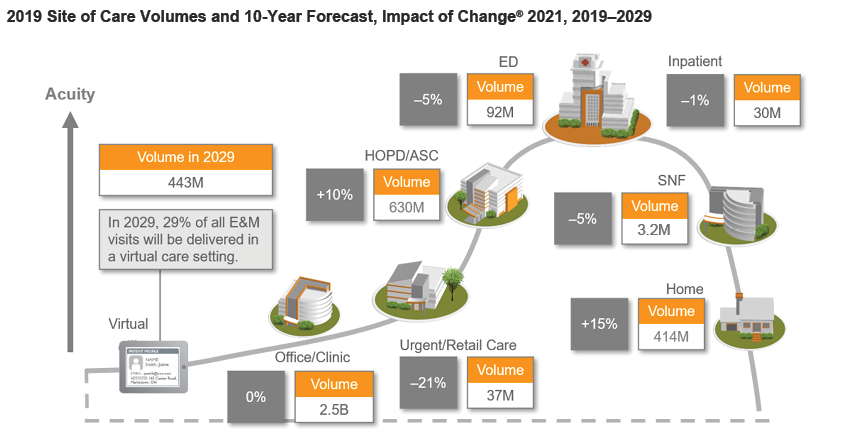

Each year at Sg2 we debut the latest health care projections from our 10-year Impact of Change® (IoC) national demand forecast. After a year of sharp declines in volume and pronounced shifts in site of care, 2021 recovery to pre-pandemic utilization takes hold, with some key exceptions. Inpatient admissions, which declined approximately 10% nationally in 2020, are projected to largely recover by 2022 but remain flat to declining 1% over the remainder of the decade. The declining inpatient use rates are the result of an accelerated surgical outpatient shift and the gradual scaling of risk-based payment models, remote monitoring and hospital at home, which drives care delivery innovation in the home and ambulatory setting. In addition, declining birth rates will drive inpatient declines for maternity and neonatal care. At the same time, rising chronic disease and mental health rates continue to fuel inpatient demand and drive higher-acuity care demands across the System of CARE. Hospitals are left with sicker patients with longer lengths of stay. COVID-19 exacerbated this trajectory, both directly, in the deleterious long-term conditions caused by this virus, and indirectly, in the disruption to the health care system resulting in delayed and deferred care. In addition, the pandemic exposed significant gaps in health care services and harsh differences in health outcomes and access related to race and socioeconomics. Health inequity is projected to continue to be a factor in rising demand for chronic disease and mental health services, particularly avoidable care utilization, offsetting some of the gains in outpatient shift and inpatient declines.

Overall, outpatient volumes are projected to reach and surpass 2019 volumes during 2022 and grow slightly above population estimated growth over the decade. Expanded insurance coverage (exchanges and Medicaid), an aging population and the rise in chronic disease are the main drivers of growth. In the short term, collateral impacts of social distancing will suppress volumes for infectious disease, such as influenza, across the System of CARE, while clinical demand for chronic complications of COVID-19 will climb.

Sources: Impact of Change®, 2021; HCUP National Inpatient Sample (NIS). Healthcare Cost and Utilization Project (HCUP) 2018. Agency for Healthcare Research and Quality, Rockville, MD; Proprietary Sg2 All Payer Claims Data Set, 2018; The following 2018 CMS Limited Data Sets (LDS): Carrier, Denominator, Home Health Agency, Hospice, Outpatient, Skilled Nursing Facility; Claritas Pop-Facts®, 2021; Sg2 Analysis, 2021.

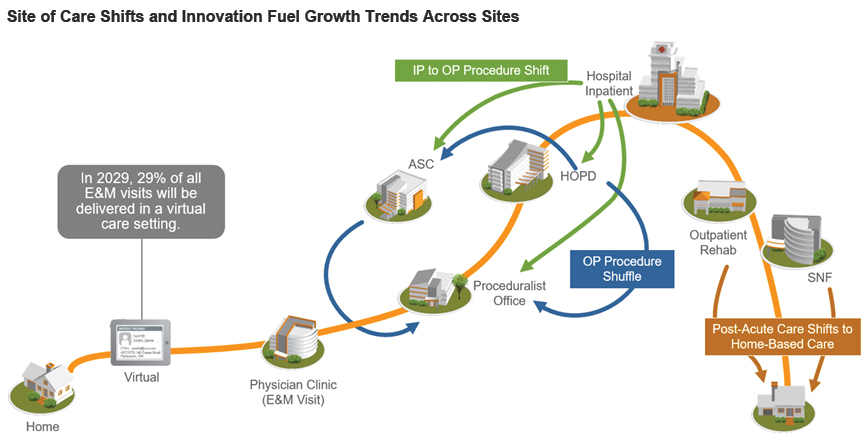

Shifts in Site of Care

The pandemic ushered in new care models and site of care shifts driven by clinical necessity, which will forever change where care is delivered. Outpatient surgical shift, decanting of the ED to alternative care sites and adoption of virtual visits have proved possible and effective and are not expected to return to pre-pandemic levels.

Note: Analysis excludes 0–17 age group. ASC = ambulatory surgery center; E&M = evaluation and management; HOPD = hospital outpatient department; SNF = skilled nursing facility. Sources: Impact of Change®, 2021; Proprietary Sg2 All-Payer Claims Data Set, 2018; The following 2018 CMS Limited Data Sets (LDS): Carrier, Denominator, Home Health Agency, Hospice, Outpatient, Skilled Nursing Facility; Claritas Pop-Facts®, 2021; Sg2 Analysis, 2021.

Note: Analysis excludes 0–17 age group. Sources: Impact of Change®, 2021; HCUP National Inpatient Sample (NIS). Healthcare Cost and Utilization Project (HCUP) 2018. Agency for Healthcare Research and Quality, Rockville, MD; Proprietary Sg2 All-Payer Claims Data Set, 2018; The following 2018 CMS Limited Data Sets (LDS): Carrier, Denominator, Home Health Agency, Hospice, Outpatient, Skilled Nursing Facility; Claritas Pop-Facts®, 2021; Sg2 Analysis, 2021.

Surgical Shuffle

Accelerated site of care shift for surgeries will be driven by changing practice patterns during the pandemic, adoption of minimally invasive procedures and increased investment by private equity in ambulatory surgery centers. The rate of surgical shift to HOPD, ASC and the physician office will vary by specialty and procedure. For example, there will be a more limited impact on the CV service line as major cardiac surgical procedures, due to complexity and patient safety, will require lengths of stays that meet the Two-Midnight rule. A majority of the other lower-complexity CV procedures, such as electrophysiology procedures and cardiac catheterizations, are already performed in the hospital outpatient department. (Note, this paragraph was updated on July 22, 2021 upon CMS announcing that the IPO list will not be eliminated.)

However, expect an uptick in outpatient shift for orthopedic and spine procedures in 2021, followed by other service line procedures, such as neuro and general medicine, in 2022 and beyond. It is important to highlight that a surgical volume shift will occur beyond the hospital setting to the lower-cost ambulatory setting, mandating a clear understanding of what procedures are at risk for shifting and where (eg, HOPD, ASC, physician office) and aligning this with a System of CARE strategy that includes investment in physician alignment and physical footprint. For more details on specific service line surgical shifts, please refer to Sg2’s Intelligence briefings, Create a Market-Level Ambulatory Procedure Forecast and Ambulatory Shift of Cardiovascular Procedures.

Emergency Department Volumes

ED visits remained sharply down in 2020, about 20% decline in volumes nationally from 2019. While consumer reticence sparked the decline, the shift to alternative care sites for low-acuity conditions was well underway prior to the pandemic. Beginning in 2017, national ED volumes remained flat and low-acuity urgent visits declined. This trend continued with national ED volumes falling 1% in 2018. While we expect low-acuity ED visits to continue to shift out of the ED, the significant drop experienced this year in both urgent and emergent visits is expected to partially rebound once social distancing measures are removed. The resultant decline in infectious disease and respiratory condition ED visits was pronounced in 2020 due to the collateral impact of strict social distancing measures. Declines are expected to continue through 2021 but gradually return in 2022 and 2023 with relaxation of these guidelines.

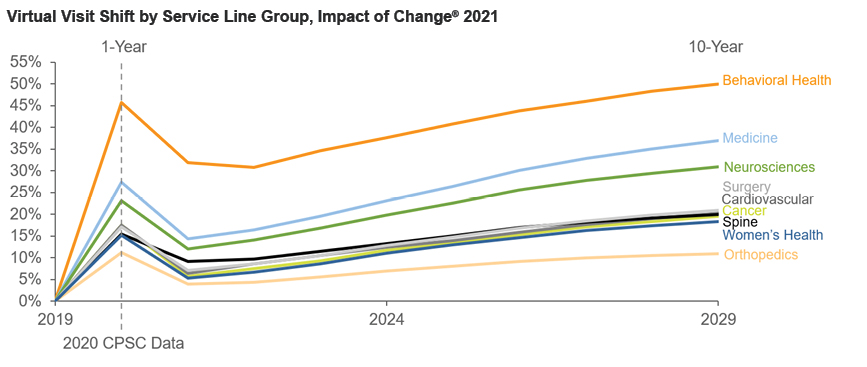

Virtual Visits

Virtual visit use increased dramatically in 2020, but as in-person visits returned in the fall and winter, sustained adoption of virtual varied by specialty and service line. Using Vizient Clinical Practice Solutions Center data insights to see differences in virtual shift by specialty, it was revealed that the behavioral health and neurology specialties continued to experience a high proportion of visits performed virtually throughout 2020 and into 2021. This year’s forecast projections track these differences between service lines. Overall, E&M visits are projected to grow 14% over the decade, with 29% of these expected to be performed virtually by 2029. As a result of this virtual shift, in-person visits are forecasted to decline by 19%. Variation in degree of shift to virtual is expected by specialty and service line depending on the services and diagnostics required. The advances made in digital infrastructure, remote monitoring and diagnostics, and payment during the pandemic have led to enduring care delivery changes to not only virtual visits but also home diagnostics, infusions, physical therapy and hospital at home services that allow patients to be cared for in the home in place of the hospital, HOPD and post-acute settings.

Note: Analysis excludes volumes for ICD-10 diagnosis code U07.1, COVID-19 infection. AAMC = Association of American Medical Colleges; CPSC = Clinical Practice Solutions Center. Sources: Impact of Change®, 2021; Proprietary Sg2 All-Payer Claims Data Set, 2018; The following 2018 CMS Limited Data Sets (LDS): Carrier, Denominator, Home Health Agency, Hospice, Outpatient, Skilled Nursing Facility; Claritas Pop-Facts®, 2021; Sg2 Analysis, 2021; AAMC-Vizient Clinical Practice Solutions Center©, 2021.

Hyperlocalization

The national IoC forecast is valuable for understanding universal trends in health care. However, Sg2 also recognizes that all health care is local. That is why our forecast is anchored to a data-driven methodology for forecasting at the market level.

Our localized market forecasts include Hyperlocalization, which incorporates market conditions (using market data and national benchmark comparatives) to more accurately forecast growth trends for an individual market. The overall result is a forecast founded on Sg2’s expert thinking on national forecast trends, augmented to capture the market differences in demographic projections, baseline case mix and utilization rates, consumer behavior, uninsured rates, and shift-to-value timing (including timing of OP shift for total joint replacement). The hyperlocalization enhancement is included in all Sg2 members’ localized market and organization forecasts. For more information on Sg2’s hyperlocalization forecast capabilities, reach out to us at learnmore@sg2.com.

Sources: Impact of Change®, 2021; HCUP National Inpatient Sample (NIS). Healthcare Cost and Utilization Project (HCUP) 2018. Agency for Healthcare Research and Quality, Rockville, MD; Proprietary Sg2 All-Payer Claims Data Set, 2018; The following 2018 CMS Limited Data Sets (LDS): Carrier, Denominator, Home Health Agency, Hospice, Outpatient, Skilled Nursing Facility; Claritas Pop-Facts®, 2021; Sg2 Analysis, 2021; AAMC-Vizient Clinical Practice Solutions Center©, 2021; Vizient Clinical Data Base/Resource Manager™. Irving, TX: Vizient, Inc.; 2020. https://www.vizientinc.com. Accessed March, 2021; Strata Decision Technology. National Patient and Procedure Volume Tracker™. Accessed May 2021; American Hospital Association (AHA). AHA DataQuery™. Accessed May 2021.

Sg2 members can dive deeper into the IoC forecast details by watching our recent forecast highlights webinar on-demand and reading additional Expert Insights that explore service line forecast implications.

Tags: ambulatory settings, care delivery, chronic conditions, consumer confidence, coronavirus, coverage erosion, COVID-19, E&M visits, ED visits, health care utilization, home care services, impact of change forecast, inpatient admissions, long-term disease burden, monitoring technologies, outpatient volumes, patient safety, payer mix deterioration, payment models, population growth, recovery, remote diagnostics, shift to value, site of care shift, strategic execution, urgent care, urgent visits, virtual visits, volume decline