Physician Alignment for Successful Outpatient Procedure Shift

With the Strategy Accelerator program, efforts to strategically prioritize your physician alignment initiative take shape

Note: Eric Lam, Associate Principal, Sg2, and Jennifer O’Connor, FACHE, Principal, Sg2, also contributed to this post.

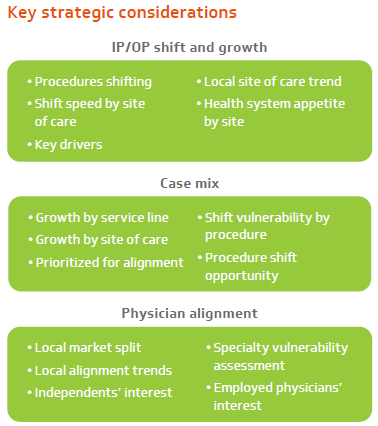

As internal and external pressures push care out of the hospital, health systems must identify the best clinical opportunities and local trends for expanding their ambulatory business. Innovator organizations understand there are both opportunities and vulnerabilities amid wide variations in which the shift is occurring in local markets. Precisely calibrating to manage that OP shift is the challenge.

To identify risk and prioritize opportunities, 38 organizations recently participated in a physician alignment accelerator program offered by Vizient, Sg2’s parent company. Sg2 faculty led the group through six weeks of education, peer-to-peer discussion and local data analysis designed to advance strategic positioning.

Leading Insights

Physician alignment.

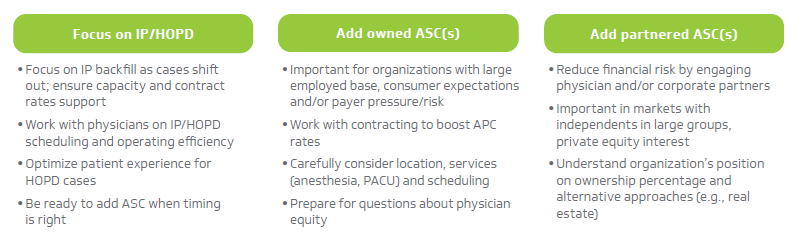

Employment was the dominant alignment mode of participating organizations with minimal joint venture activity. Seventy percent of participants’ surgical volumes were performed by employed physicians. Such reliance on employment presents risk as volumes shift OP and proceduralists look for equity opportunities. It is important for health systems to assess potential loss of volumes and revenue if they undertake no actions amid the OP shift. Broader use of joint venture partnerships with independent physicians may prevent a total loss of revenue from key procedures.

Considerations on whether to pursue ASCs include ownership, specialty mix, location and consumer impact. A plurality of participating organization (45%) said they were willing to partner with independent physicians on an ASC if the health system retained 51% ownership, a stance that may not attract increasingly entrepreneurial and privately financed physician groups.

Financial drivers.

Accelerator participants identified payer pressure (43%) and IP capacity constraints (27%) as key drivers of their increasing focus on the OP procedure shift. That pressure was greatest from larger commercial payers.

Participants identified orthopedics as both the specialty that was shifting fastest to OP in their local market (73%) and the service line that was most important to achieving current organizational growth and margin goals (59%).

In the category of major orthopedic procedures, participants were projected to lose $10.1 million in five years from the decline in IP volumes but gain $63.6 million from shift to the HOPD and $2.4 million from ASC shifts. And they could improve those financials by working to capture a larger portion of their markets’ projected ASC growth for orthopedic procedures.

Among health system participants with ASCs, 53% are currently running at 75%-99% capacity. Reduced reimbursement in the ASC setting challenges margins and makes center optimization—both operational efficiency and physician buy-in to bring cases—critical.

Site of care shift.

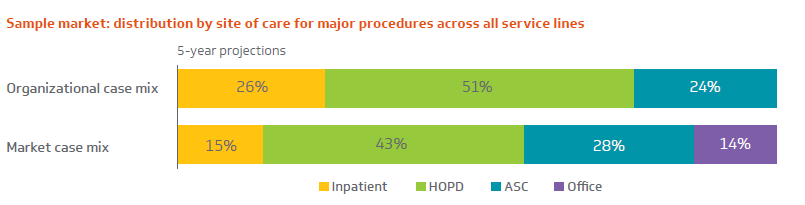

Across accelerator participants, inpatient volumes are expected to decline (0% to -4%) over the next five years, while outpatient volumes will grow from 6% to 14% based on site of care and local market variations.

Participating organizations’ major procedure case mix was much more reliant on IP volumes (31%) than their local markets (17%), signaling others in the market may already be better positioned to capitalize on OP shift trends. While many participants rightfully noted a focus on future HOPD growth, not planning for additional shifts to the ASC or even the physician office would be shortsighted.

Next steps: understand the options

Additional support

Sg2 and Vizient Advisory Services help members with: (1) capacity analysis and facility sizing and planning across the care continuum, (2) ASC joint venture and comanagement agreement development and facilitation, (3) employed medical group compensation and incentive alignment, and (4) perioperative services and operating room efficiency. Contact your account executive or LearnMore@sg2.com for more information.